| Category of Scheme |

Multi Cap Fund |

Small Cap Fund |

Mid Cap Fund |

Focused Fund |

Value |

Large & Mid Cap Fund |

Thematic |

Thematic |

Thematic – Quant |

Flexi Cap |

Large Cap |

Dynamic Asset Allocation |

Business Cycle |

Thematic |

Thematic |

Thematic |

Thematic |

Thematic |

Thematic |

Thematic |

Thematic |

ELSS |

Aggressive Hybrid Fund |

Multi Asset Allocation |

Liquid Fund |

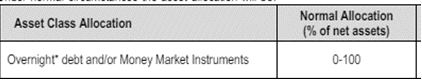

Overnight Fund |

Gilt Fund |

| Type of Scheme |

An open ended equity scheme investing across large cap, mid cap, small cap Companies |

An open ended equity scheme investing in Small Cap portfolio of Equity Shares. |

An open ended equity scheme investing in Mid Cap Companies.

|

An open ended equity scheme investing in maximum 30 large cap stocks. |

An open ended equity scheme investing in a well-diversified portfolio of value stocks |

An open ended equity scheme investing across Large & Mid Cap Companies |

An open ended equity scheme investing in the companies of Infrastructure sector |

An Open ended equity scheme investing in companies demonstrating sustainable practices across Environment, Social and Governance (ESG) theme. |

An open ended Equity Scheme investing based on a quant model theme.

|

An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocks |

An open ended equity scheme investing across Large Cap Companies

|

An Open Ended Dynamic Asset Allocation Fund |

An open-ended equity scheme following business cycles based investing theme |

An open ended equity scheme investing in banking and financial services related sectors |

An open ended equity scheme investing in healthcare sector |

An open ended equity scheme following manufacturing theme. |

An open ended equity scheme investing in technology-centric companies

|

An open ended equity scheme following momentum theme |

An open ended equity scheme investing in commodity and commodity related sectors |

An open ended equity scheme following consumption theme

|

An open ended equity scheme investing in PSU/PSU subsidiaries sector. |

An open ended equity linked saving scheme with a statutory lock in of 3 years and tax

benefit

|

An open ended hybrid scheme investing predominantly in equity and equity related instruments. |

An open ended scheme investing in equity, debt and commodity.

|

An open-ended Liquid Scheme |

An open ended Debt Scheme investing in Overnight securities

|

An open ended debt scheme investing in government securities across maturity. |

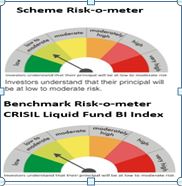

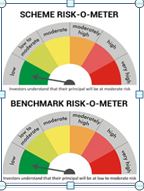

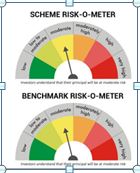

| Scheme Risk-O-Meter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Benchmark Index |

NIFTY 500 MULTICAP 50:25:25 TRI |

NIFTY SMALL CAP 250 TRI |

NIFTY MIDCAP 150 TRI |

NIFTY 500 TRI |

NIFTY 500 TRI |

Nifty Large Midcap 250 TRI |

Nifty Infrastructure TRI |

Nifty 100 ESG TRI |

NIFTY 200 TRI |

NIFTY 500 TRI |

NIFTY 100 TRI |

NIFTY 50 Hybrid Composite debt 50:50 Index |

NSE 500 TRI |

Nifty Financial Services TRI |

NIFTY Healthcare TRI |

Nifty India Manufacturing Index |

NIFTY IT TRI |

NIFTY 500 TRI |

Nifty Commodities TRI |

NIFTY India Consumption TRI |

NIFTY PSE TRI |

NIFTY 500 TRI |

NIFTY 50 Hybrid Composite Debt 65:35 Index |

65% BSE 200 TRI + 15% CRISIL Short Term Bond Fund Index + 20% iCOMDEX Composite Index |

CRISIL LIQUID FUND A1 INDEX |

CRISIL overnight Index |

CRISIL Dynamic Gilt Index |

| Investment Objective |

The primary investment objective of the scheme is to seek to generate capital appreciation & provide long-term growth opportunities by investing in a portfolio of Large Cap, Mid Cap and Small Cap companies. There is no assurance that the investment objective of the Scheme will be realized. |

The primary investment objective of the scheme is to seek to generate capital appreciation & provide long-term growth opportunities by investing in a portfolio of Small Cap companies. There is no assurance that the investment objective of the Scheme will be realized. |

The primary investment objective of the scheme is to generate capital appreciation &provide long-term growth opportunities by investing in a portfolio of Mid Cap companies.There is no assurance that the investment objective of the Scheme will be achieved.

|

The primary investment objective of the scheme is to seek to generate capital appreciation & provide long-term growth opportunities by investing in a focused portfolio of Large Cap – ‘blue chip’ – companies. There is no assurance that the investment objective of the Scheme will be realized. |

The primary investment objective of the scheme is to seek to achieve capital appreciation in the long-term by primarily investing in a well-diversified portfolio of value stocks. The AMC will have the discretion to completely or partially invest in any of the type of securities stated above with a view to maximize the returns or on defensive considerations. However, there can be no assurance that the investment objective of the Scheme will be realized, as actual market movements may be at variance with anticipated trends. |

The primary investment objective of the scheme is to seek to generate capital appreciation & provide long-term growth opportunities by investing in a portfolio of Large Cap and Mid Cap companies. There is no assurance that the investment objective of the Scheme will be realized. |

The primary investment objective of the scheme is to seek to generate capital appreciation & provide long-term growth opportunities by investing in a portfolio of Infrastructure focused companies. There is no assurance that the investment objective of the Scheme will be realized. |

To generate long term capital appreciation by investing in a diversified portfolio of companies demonstrating sustainable practices across Environmental, Social and Governance (ESG) parameters. However, there can be no assurance that the investment objective of the Scheme will be achieved. |

The investment objective of the Scheme is to deliver superior returns as compared to the underlying benchmark over the medium to long term through investing in equity and equity related securities. The portfolio of stocks will be selected, weighed and rebalanced using stock screeners, factor based scoring and an optimization formula which aims to enhance portfolio exposures to factors representing „good investing principles‟ such as growth, value and quality within risk constraints. However, there can be no assurance that the investment objective of the scheme will be realized. |

The primary investment objective of the scheme is to generate consistent returns by investing in a portfolio of Large Cap, Mid Cap and Small Cap companies. The AMC will have thediscretion to completely or partially invest in any of the type of securities stated above with aview to maximize the returns or on defensive considerations. However, there can be noassurance that the investment objective of the Scheme will be realized, as actual market movements may be at variance with anticipated trends |

The primary investment objective of the scheme is to seek to generate consistent by investing in equity and equity related instruments falling under the category of large cap companies. The AMC will have the discretion to completely or partially invest in any of the type of securities stated above with a view to maximize the returns or on defensive considerations. However, there can be no assurance that the investment objective of the Scheme will be realized, as actual market movements may be at variance with anticipated trends. |

The primary investment objective of the scheme is to provide capital appreciation by investing in equity and equity related instruments including derivatives and debt and money market instruments. However, there can be no assurance that the investment objective of the Scheme will be realized, as actual market movements may be at variance with anticipated trends. |

To generate long-term capital appreciation by investing with focus on riding business cycles through allocation between sectors and stocks at different stages of business cycles. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns. |

The primary investment objective of the scheme is to generate consistent returns by investing in equity and equity related instruments of banking and financial services. However, there is no assurance that the investment objective of the Scheme will be achieved. |

The investment objective of the scheme is to seek long term capital appreciation by investing in equity/equity related instruments of companies from the healthcare sector. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. |

The primary objective of the scheme is to generate long term capital appreciation by investing in equity and equity related instruments of companies that follow the manufacturing theme. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns |

The primary investment objective of the scheme is to seek to generate consistent returns by investing in equity and equity related instruments of technology-centric companies. However, there can be no assurance that the investment objective of the Scheme will be realized, as actual market movements may be at variance with anticipated trends. |

The primary investment objective of the scheme is to achieve long-term capital appreciation for its investors. This objective will be pursued by strategically investing in a diversified portfolio of equity and equity-related instruments. The selection of these instruments will be based on a quantitative model meticulously designed to identify potential investment opportunities that exhibit the potential for significant capital appreciation over the specified investment horizon. There is no assurance that the investment objective of the Scheme will be realized. |

The objective of the scheme is to generate long-term capital appreciation by creating a portfolio that is invested predominantly in Equity and Equity related securities of companies engaged in commodity and commodity related sectors. There is no assurance that the investment objective of the Scheme will be realized. |

The primary investment objective of the scheme is to generate capital appreciation & provide long-term growth opportunities by investing in a portfolio of Consumption driven companies. There is no assurance that the investment objective of the Scheme will be realized. |

The objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of Public Sector Undertakings (PSUs). There is no assurance that the investment objective of the Scheme will be realized. |

The investment objective of the Scheme is to generate Capital Appreciation by investing predominantly in a well diversified portfolio of Equity Shares with growth potential. This income may be complemented by possible dividend and other income. |

The investment objective of the scheme is to generate income/capital appreciation by investing primarily in equity and equity related instruments with a moderate exposure to debt securities & money market instruments. There is no assurance that the investment objective of the Scheme will be realized. |

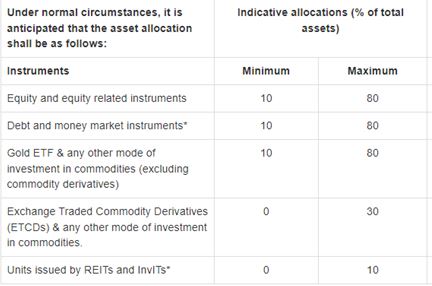

The investment objective of the scheme is to generate capital appreciation & provide longterm growth opportunities by investing in instruments across the three asset classes viz.

Equity, Debt and Commodity. There is no assurance that the investment objective of the

Scheme will be realized.

|

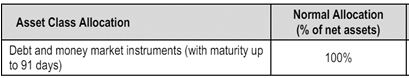

The investment objective of the scheme is to generate income through a portfolio comprising money market and debt instruments. There is no assurance that the investment objective of the Scheme will be realized. |

The investment objective of the scheme is to generate returns by investing in debt and money market instruments with overnight maturity. However, there can be no assurance that the investment objective of the Scheme will be realized. |

To generate returns through investments in sovereign securities issued by the Central Government and/or State Government. However, there can be no assurance that the investment objective of the Scheme will be realized. |

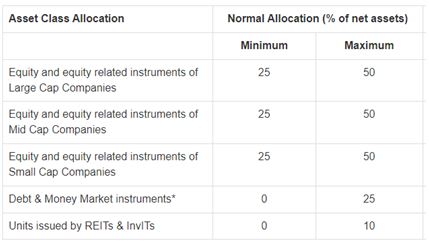

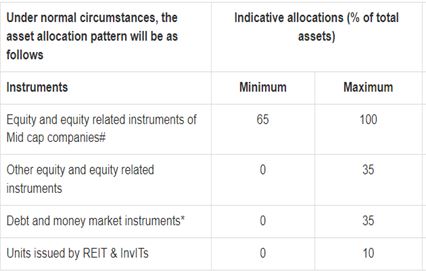

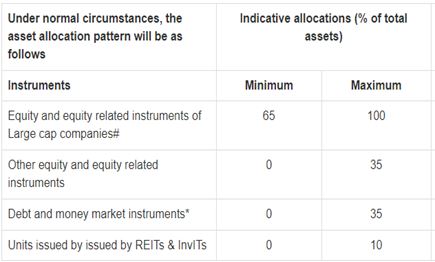

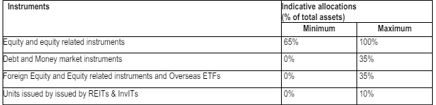

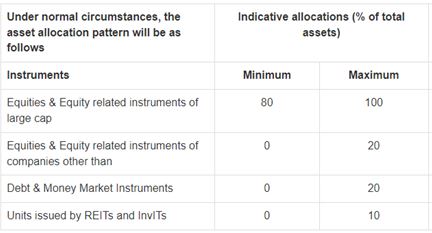

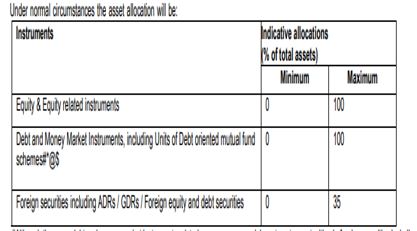

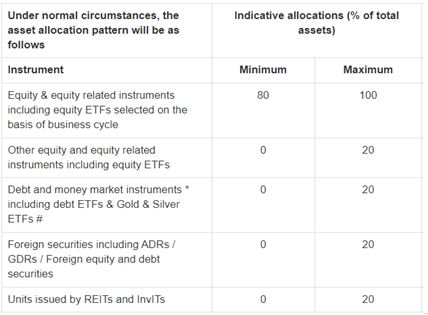

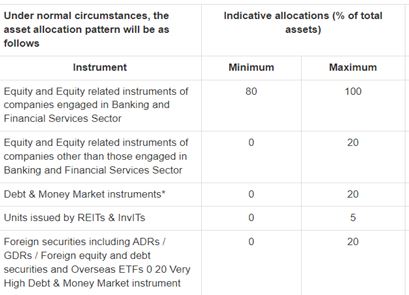

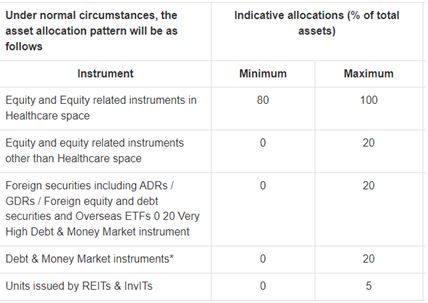

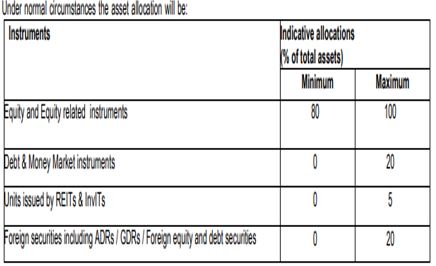

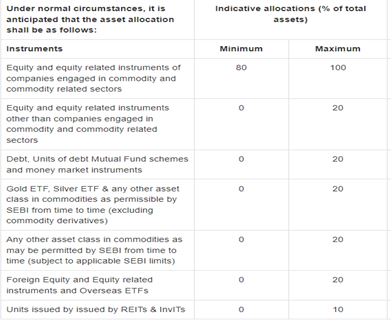

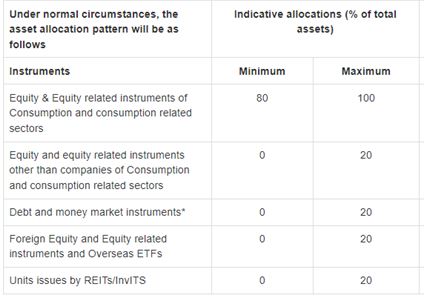

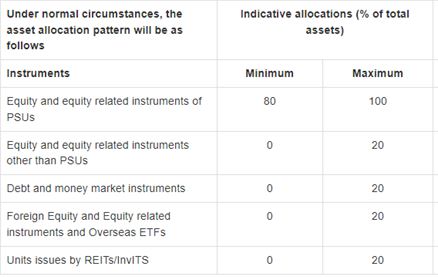

| Asset Allocation Pattern |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lock-In Period |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

3 Years from the date of allotment of the respective Units. |

Nil |

Nil |

Nil |

Nil |

Nil |

| Exit Load |

Exit Load - 15 Days / 1% Effective from August 11, 2023 |

Exit Load : 1% if exit <= 1 Year |

Exit: 0.5% if exit <= 3 Months |

Exit Load - 15 Days / 1% Effective from August 11, 2023 |

Exit Load -15 Days / 1% Effective from August 11, 2023 |

Exit Load -15 Days / 1% Effective from August 11, 2023 |

Exit: 0.5% if exit <= 3 Months |

Exit Load - 15 Days / 1% Effective from August 11, 2023 |

Exit Load - 15 Days / 1% Effective from August 11 ,2023 |

Exit Load - 15 Days / 1% Effective from August 11 ,2023 |

Exit Load - 15 Days / 1% Effective from August 11 ,2023 |

Exit Load - 15 Days / 1% Effective from August 11 ,2023 |

Exit Load - 15 Days / 1% Effective from August 11 ,2023 |

Exit Load - 15 Days / 1% Effective from August 11 ,2023 |

Exit Load - 15 Days / 1% Effective from August 11 ,2023 |

Exit Load - 15 Days / 1% Effective from August 11 ,2023 |

Exit Load - 15 Days / 1% Effective from August 11 ,2023 |

Exit Load - 15 Days / 1% Effective from August 11 ,2023 |

Exit Load - 15 Days / 1% Effective from August 11 ,2023 |

Exit Load - 15 Days / 1% Effective from August 11 ,2023 |

Exit Load - 15 Days / 1% Effective from August 11 ,2023 |

- |

Exit Load - 15 Days / 1% Effective from August 11, 2023 |

Exit Load - 15 Days / 1% Effective from August 11, 2023 |

taggered Exit load for 6 days , from day 7 days onwards nil *Day 1 - 0.0070%", Day 2 - 0.0065%", Day 3 - 0.0060%", Day 4 - 0.0055%", Day 5 - 0.0050%", Day 6 - 0.0045%", Day 7 – Nil |

- |

- |

| Inception Date |

17-Apr-01 |

29-Oct-96 |

20-Mar-01 |

28-Aug-08 |

30-Nov-21 |

08-Jan-07 |

20-Sep-07 |

05-Nov-20 |

03-May-21 |

17-Oct-08 |

11-Aug-22 |

12-Apr-23 |

30-May-23 |

20-Jun-23 |

17-Jul-23 |

16th August, 2023 |

11th September, 2023 |

20th November, 2023 |

27th December, 2023 |

24th January, 2024 |

20th February, 2024 |

13-Apr-2000 |

17-Apr-01 |

17-Apr-01 |

03-Oct-05 |

04-Dec-22 |

21-Dec-22 |

| Minimum Application Amount |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 500/- and any amount thereafter\nFor existing investors, INR 500/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 500/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

For new investor, INR 5000/- and any amount thereafter\nFor existing investors, INR 1000/- and any amount thereafter\nFor Systematic Investment Plan (SIP), the minimum amount is INR 1000/- and in multiples of INR 1/- thereafter. |

| Fund Manager |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr. Lokesh Garg , Mr. Varun Pattani, Ms. Ayusha Kumbhat, Mr. Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr. Varun Pattani , Ms. Ayusha Kumbhat , Mr.Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande,Mr. Varun Pattani , Ms. Ayusha Kumbhat, Mr. Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande,Mr.Lokesh Garg, Mr. Varun Pattani , Ms. Ayusha Kumbhat, Mr. Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande,Mr. Varun Pattani , Ms. Ayusha Kumbhat, Mr. Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande,Mr. Varun Pattani , Ms. Ayusha Kumbhat, Mr. Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr.Sandeep Tandon, Mr.Ankit Pande, Mr. Lokesh Garg, Ms.Ayusha Kumbhat, Mr.Varun Pattani, Mr.Yug Tibrewal, Mr.Sameer Kate, Mr.Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande,Mr. Varun Pattani , Ms. Ayusha Kumbhat, Mr. Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande,Mr. Varun Pattani , Ms. Ayusha Kumbhat, Mr. Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr.Sandeep Tandon, Mr.Ankit Pande,Mr. Lokesh Garg, Mr.Varun Pattani, Ms.Ayusha Kumbhat, Mr.Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr.Sandeep Tandon, Mr.Ankit Pande,Mr. Lokesh Garg, Mr.Varun Pattani, Ms.Ayusha Kumbhat, Mr.Yug Tibrewal, Mr.Sameer Kate,Mr. Sanjeev Sharma |

Mr.Sandeep Tandon,Mr. Ankit Pande, Mr.Sameer Kate,Mr.Varun Pattani, Ms.Ayusha Kumbhat, Mr.Yug Tibrewal, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr.Lokesh Garg,Mr.Varun Pattani, Ms.Ayusha Kumbhat, Mr.Yug Tibrewal, Mr.Sameer Kate, Mr.Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr.Varun Pattani, Ms. Ayusha Kumbhat,Mr.Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr.Varun Pattani ,Ms.Ayusha Kumbhat, Mr.Yug Tibrewal, Mr. Sameer Kate, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr.Varun Pattani, Mr.Lokesh Garg, Ms.Ayusha Kumbhat, Mr.Yug Tibrewal, Mr.Sameer Kate, Mr.Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr.Varun Pattani, Ms.Ayusha Kumbhat,Mr.Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr.Sameer Kate, Mr.Varun Pattani, Ms.Ayusha Kumbhat, Mr.Yug Tibrewal, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr.Sameer Kate, Mr.Varun Pattani, Ms.Ayusha Kumbhat, Mr.Yug Tibrewal,Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr.Sameer Kate, Mr.Varun Pattani, Ms.Ayusha Kumbhat, Mr.Yug Tibrewal,Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr. Varun Pattani, Ms.Ayusha Kumbhat, Mr.Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr. Varun Pattani, Ms.Ayusha Kumbhat, Mr.Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr. Lokesh Garg, Mr.Varun Pattani, Ms.Ayusha Kumbhat, Mr.Yug Tibrewal, Mr.Sameer Kate, Mr. Sanjeev Sharma |

Mr. Sandeep Tandon, Mr. Ankit Pande, Mr. Sameer Kate, Mr.Varun Pattani, Ms.Ayusha Kumbhat, Mr.Yug Tibrewal, Mr. Sanjeev Sharma |

Mr. Sanjeev Sharma, Mr. Harshvardhan Bharatia |

Mr. Sanjeev Sharma, Mr. Harshvardhan Bharatia |

Mr. Sanjeev Sharma, Mr. Harshvardhan Bharatia |

| Minimum Investment Amount |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

5000 |

500 |

5000 |

5000 |

5000 |

5000 |

5000 |

| Minimum Investment for SIP |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

1000 |

500 |

1000 |

1000 |

1000 |

1000 |

1000 |

| Plans Available |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

Regular Plan and Direct Plan.\n(The Regular and Direct plan will have a common portfolio) |

| Options Available |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth option and 2. IDCW The IDCW option has the following facilities:(1)IDCW Pay-out Facility Default. Investment Option is Growth For the IDCW option ,the default facility will be IDCW Pay-out |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

1.Growth Option and 2. IDCW\nThe IDCW option has the following facilities: (i) IDCW Reinvestment Facility. (ii) IDCW Pay-out Facility. Default Investment option is Growth Option. For the IDCW option, the default facility will be IDCW Reinvestment. |

| Applicable NAV |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

The NAV applicable for purchase or redemption or switching of Units based on the time of the Business Day on which the application is time stamped. |

| Risk Factors |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

For detailed scheme/securities related risk factors, please refer to the Scheme Information Document |

Quant Capital Finance and Investments Private Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. |

| Investment strategy |

The Scheme will invest in a portfolio of Large Cap, Mid Cap and Small Cap companies in line with the investment manager’s views on the macro economy with a particular focus on the sentiments of the market participants through the interpretation of quant Money Mangers’ predictive analytical tools and macro indicators. The emphasis will be on identifying companies with strong sustainable competitive advantages in good businesses and having sound managements. The fund managers will follow a dynamic investment strategy taking defensive/aggressive postures depending on the the overall risk-on / risk-off environment. In a risk-off environment, the scheme may invest substantially in money market instruments to protect the interest of the investors in the scheme. In line with SEBIs requirement for Multi cap schemes, the quant Active Fund will invest a minimum of 25% in equity & equity related instruments of Large Cap companies, 25% in equity & equity related instruments of Mid Cap companies and 25% in equity & equity related instruments of Small Cap companies. The remaining 25% will be invested based on the investment manager’s views and accordingly allocated towards Large Cap, Mid Cap, Small Cap stocks and/or debt and money market instruments. The portfolio is reviewed consistently on the basis of the macro-economic environment and changes are made based on the data generated by our analytics and on the discretion of the fund manager. The change in the portfolio involves both sale and purchase, both partial and complete, of the existing stocks and purchase of new stocks, if any. In lieu of the overarching risk-on / risk-off environment, the scheme performs a strategic sector rotation in order to generate risk-adjusted returns. All investment decisions are based on quant money managers’ investment framework – VLRT. In the face of this uncertainty and complexity, we have found consistent success by studying markets along four dimensions as opposed to limiting ourselves to any one school of thought: Valuation Analytics, Liquidity Analytics, Risk Appetite Analytics, and Timing. |

To achieve the investment objective, the scheme will invest primarily in equity and equity linked instruments of Small Cap companies as defined by

SEBI. The underlying theme driving the relative allocation will be QMML research’s ability to identify cross asset, cross market inflexion points. This

quantitative approach is based on our proprietary VLRT framework, wherein we incorporate the full spectrum of data along deeper aspects related

to the three axis of Valuation, Liquidity, and Risk appetite and view it in a dynamic setting – Time, thus, forming the multi-dimensional VLRT

framework. The formulation of this macro narrative guides our micro level stock selection.QMML’s predictive analytics toolbox formulates a multidimensional research perspective to various asset classes. Research has shown that optimal

entry and exit points into various asset classes can be identified through the identification of bouts of extreme greed and fear in the market. QMML

differentiates itself by not only being able to identify bouts of greed and fear, but by its ability to quantify bouts of euphoria and capitulation. This

helps guide us in identifying the optimal level of cash/debt allocation in the scheme.QMML may, from time to time, review and modify the Scheme’s investment strategy if such changes are considered to be in the best interests of

the unitholders and if market conditions warrant it. Though every endeavor will be made to achieve the objective of the Scheme, the AMC /

Sponsors / Trustee do not guarantee that the investment objective of the Scheme will be achieved. No guaranteed returns are being offered under

the Scheme.All investment decisions are based on quant money managers’ investment framework – VLRT. In the face of this uncertainty and complexity, we

have found consistent success by studying markets along four dimensions as opposed to limiting ourselves to any one school of thought:

Valuation Analytics, Liquidity Analytics, Risk Appetite Analytics, and Timing.

|

To achieve the investment objective, the scheme will invest primarily in equity and equity linked instruments of Mid Cap companies as defined by SEBI.

The underlying theme driving the relative allocation will be qMML research’s ability to identify cross asset, cross market inflexion points.

This quantitative approach is based on our proprietary VLRT framework, wherein we incorporate the full spectrum of data along deeper aspects related to the three axis of Valuation, Liquidity, and Risk appetite and view it in a dynamic setting – Time, thus, forming the multi-dimensional VLRT framework.

The formulation of this macro narrative guides our micro level stock selection. qMML’s predictive analytics toolbox formulates a multidimensional research perspective to various asset classes.

Research has shown that optimal entry and exit points into various asset classes can be identified through the identification of bouts of extreme greed and fear in the market.

qMML differentiates itself by not only being able to identify bouts of greed and fear, but by its ability to quantify bouts of euphoria and capitulation.

This helps guide us in identifying the optimal level of cash/debt allocation in the scheme.

qMML may, from time to time, review and modify the Scheme’s investment strategy if such changes are considered to be in the best interests of the unitholders and if market conditions warrant it.

Though every endeavor will be made to achieve the objective of the Scheme, the AMC / Sponsors / Trustee do not guarantee that the investment objective of the Scheme will be achieved.

No guaranteed returns are being offered under the Scheme. |

To achieve the investment objective, the scheme will invest primarily in a relatively concentrated portfolio of equity and equity linked instruments of Large Cap – blue chip – companies as defined by SEBI. The underlying theme driving the relative allocation will be qMML research’s ability to identify cross asset, cross market inflexion points.

This quantitative approach is based on our proprietary VLRT framework, wherein we incorporate the full spectrum of data along deeper aspects related to the three axis of Valuation, Liquidity, and Risk appetite and view it in a dynamic setting – Time, thus, forming the multi-dimensional VLRT framework.

The formulation of this macro narrative guides our micro level stock selection. qMML’s predictive analytics toolbox formulates a multidimensional research perspective to various asset classes.

Research has shown that optimal entry and exit points into various asset classes can be identified through the identification of bouts of extreme greed and fear in the market. qMML differentiates itself by not only being able to identify bouts of greed and fear, but by its ability to quantify bouts of euphoria and capitulation.

This helps guide us in identifying the optimal level of cash/debt allocation in the scheme. qMML may, from time to time, review and modify the Scheme’s investment strategy if such changes are considered to be in the best interests of the unitholders and if market conditions warrant it.

Though every endeavor will be made to achieve the objective of the Scheme, the AMC / Sponsors / Trustee do not guarantee that the investment objective of the Scheme will be achieved.

No guaranteed returns are being offered under the Scheme. |

The Scheme is an open-ended Scheme that aims to provide long term capital growth by investing primarily in a well-diversified portfolio of

companies that are selected based on the criteria of Relative value investing. Relative value investing is an investment strategy where stocks are

selected that trade for less than their perceived intrinsic values. It may also include stocks likely to benefit out of turnaround of business and value

unlocking opportunities such as mergers, demergers, acquisition, etc.

The Scheme proposes to accumulate a portfolio of well-diversified stocks, which are available at a discount relative to their perceived intrinsic value

through a process of ‘Discovery’ by using our VLRT investment framework. The Discovery process would be through identification of stocks, which

have attractive valuations in relation to Valuation Analytics, Liquidity Analytics & Risk Appetite Analytics. This may constitute stocks, which have

depreciated for a short period due to some exceptional circumstance or due to market correction phase or due to lack of interest in investing in a

sector (which has significantly under-performed the market). This may also include stocks likely to benefit from turnaround of business and relative

value unlocking opportunities such as mergers, demergers, acquisition, any corporate action etc.

The Scheme will invest in line with the investment manager’s views on the macro economy with a particular focus on the sentiments of the market

participants through the interpretation of quant Money Mangers’ Predictive Analytical tools and macro indicators. The fund managers will follow a

dynamic investment strategy taking defensive/aggressive postures depending on the overall risk-on / risk-off environment. The portfolio shall be

reviewed consistently on the basis of the macro-economic environment and changes will be made based on the data generated by our analytics

and on the discretion of the fund manager. |

To achieve the investment objective, the scheme will primarily invest in equity and equity linked instruments of Large Cap and Mid Cap companies as defined by SEBI.

The underlying theme driving the relative allocation will be qMML research’s ability to identify cross asset, cross market inflexion points.

This quantitative approach is based on our proprietary VLRT framework, wherein we incorporate the full spectrum of data along deeper aspects related to the three axis of Valuation, Liquidity, and Risk appetite and view it in a dynamic setting – Time, thus, forming the multi-dimensional VLRT framework.

The formulation of this macro narrative guides our micro level stock selection.

qMML’s predictive analytics toolbox formulates a multidimensional research perspective to various asset classes.

Research has shown that optimal entry and exit points into various asset classes can be identified through the identification of bouts of extreme greed and fear in the market. qMML differentiates itself by not only being able to identify bouts of greed and fear, but by its ability to quantify bouts of euphoria and capitulation.

This helps guide us in identifying the optimal level of cash/debt allocation in the scheme.

qMML may, from time to time, review and modify the Scheme’s investment strategy if such changes are considered to be in the best interests of the unitholders and if market conditions warrant it.

Though every endeavor will be made to achieve the objective of the Scheme, the AMC / Sponsors / Trustee do not guarantee that the investment objective of the Scheme will be achieved. No guaranteed returns are being offered under the Scheme. |

To achieve the investment objective, the scheme will primarily invest in equity and equity linked instruments of companies which operate in the ‘Infrastructure’ sector.

In qMML’s view the proactive steps being implemented by policymakers to correct the nation’s infrastructure deficit presents a long term opportunity. The fund will aim to actively identify and invest in companies which are most likely to benefit from this opportunity.

The underlying theme driving the relative allocation will be qMML research’s ability to identify cross asset, cross market inflexion points.

This quantitative approach is based on our proprietary VLRT framework, wherein we incorporate the full spectrum of data along deeper aspects related to the three axis of Valuation, Liquidity, and Risk appetite and view it in a dynamic setting – Time, thus, forming the multi-dimensional VLRT framework.

The formulation of this macro narrative guides our micro level stock selection.

qMML’s predictive analytics toolbox formulates a multidimensional research perspective to various asset classes.

Research has shown that optimal entry and exit points into various asset classes can be identified through the identification of bouts of extreme greed and fear in the market.

qMML differentiates itself by not only being able to identify bouts of greed and fear, but by its ability to quantify bouts of euphoria and capitulation.

This helps guide us in identifying the optimal level of cash/debt allocation in the scheme.

qMML may, from time to time, review and modify the Scheme’s investment strategy if such changes are considered to be in the best interests of the unitholders and if market conditions warrant it.

Though every endeavor will be made to achieve the objective of the Scheme, the AMC / Sponsors / Trustee do not guarantee that the investment objective of the Scheme will be achieved.

No guaranteed returns are being offered under the Scheme. |

The investment strategy of the Scheme will be to invest in a basket of securities based on combining existing traditional fundamental, bottom-up financial analysis along with a rigorous analysis on the environmental, social and governance aspects of the company. The ESG analysis will be based on a comprehensive ESG framework adopted from some of the global best practices. The ESG process will be executed at various levels.

Sector level screening: The scheme will exclude sectors/themes that are deemed harmful from a societal perspective. We will avoid investment in companies operating in those industries and maintain that exclusion on an ongoing basis. For example we will not invest in companies involved in Cluster Munitions, Anti- Personnel Mines, and Chemical and Biological Weapons. We will not hold any security that is involved in the production, stockpiling, transfer and use of these weapons.

Stock level screening: Apart from sector exclusion list, we will not invest in stocks which throw up ESG red flags as a part of our review, even if the company is from a sector that is not a part of exclusion list. Portfolio Construction: We believe that evaluating a company from an ESG perspective requires a detailed qualitative approach that should complement our existing fundamental based investment process workings rather than a simplistic standalone scoring based inclusion/exclusion matrix for individual stocks. We intend to be active owners of the companies in which we invest and to reflect environmental, social and governance (ESG) value drivers within our investment process by following below steps.

Step 1: Initial detailed ESG assessment of every company at the time of its inclusion in the investment universe will be carried out. The assessment will be based on a detailed sector- specific questionnaire that will be completed by the analyst in discussion with the company. Thus every company will undergo a detailed ESG due diligence in addition to the fundamental ground work before entering the universe. Step 2: Ongoing detailed assessment and evaluation of ESG issues or concerns will be carried out periodically to ensure that changes to the operating environment are captured. In case of any concerns on ESG front indicating any risk that may be detrimental to the long term shareholder value or in case of no evidence of any steps taken to strengthen safety measures, may lead to exclusion of the security from the universe. Step 3: In case of any specific ESG issue facing the company, a detailed review of the same to be carried out by the analyst and the impact discussed with the company management. Step 4: Active engagement with the company management, ownership in terms of improved disclosure of ESG matters and voting on proxy items keeping ESG aspect in mind.

While the more traditional financial indicators and the analysis of business strategy form the basis of investment decisions, ESG factors may impact the investments in two ways – first through size of position given its impact on the inherent risk to our financial forecasts and secondly through our view of the ultimate long term value of company based on its readiness to face some of these issues, from both an upside and downside perspective. We will primarily focus on the longer term impact of ESG issues rather than unduly weighting factors which are currently occupying market attention.

The underlying theme driving the relative allocation will be QMML research‟s ability to identify cross asset, cross market inflexion points. This quantitative approach is based on our proprietary VLRT framework, wherein we incorporate the full spectrum of data along deeper aspects related to the three axis of Valuation, Liquidity, and Risk appetite and view it in a dynamic setting – Time, thus, forming the multi-dimensional VLRT framework. The formulation of this macro narrative guides our micro level stock selection.

QMML‟s predictive analytics toolbox formulates a multidimensional research perspective to various asset classes. Research has shown that optimal entry and exit points into various asset classes can be identified through the identification of bouts of extreme greed and fear in the market. QMML differentiates itself by not only being able to identify bouts of greed and fear, but by its ability to quantify bouts of euphoria and capitulation. This helps guide us in identifying the optimal level of cash/debt Page 5 allocation in the scheme.

QMML may, from time to time, review and modify the Scheme‟s investment strategy if such changes are considered to be in the best interests of the unitholders and if market conditions warrant it. Though every endeavor will be made to achieve the objective of the Scheme, the AMC / Sponsors / Trustee do not guarantee that the investment objective of the Scheme will be achieved. No guaranteed returns are being offered under the Scheme. |

The underlying theme driving the relative allocation will be quant Money Managers Limited (qMML) research’s 'quantamental' investment strategies.

QMML believes that a quantitative approach to money management would yield optimal results when combined with the value of human judgement

as rules or factors can behave differently when the entire market environment changes, such as our predictive analytics tools suggest. Thus, the

quantamental approach seeks to find the harmony between objectivity and subjectivity.

In order to provide the best possible returns and capital preservation, the quantamental approach goes beyond purely factor-based, smart beta or

algorithmic strategies. We believe a rules-based mechanical approach needs to be combined with the value of years of human judgement and

experience to yield 'adaptive alpha' - the outperformance generated by an ability to adapt investment rules/factors to novel market phases. Thus, we

augment traditional quantitative and qualitative methods alongwith ‘sentiments data’ - a deep knowledge of market structure dynamics, micro level

stock selection and inflexion point identification between bouts of greed and fear through analysis of the larger, ever-changing macro environment.

Quantamental combines the innate human ability to adapt, adding to the alpha generated by discipline and identification of underlying factors -

adaptive alpha, providing the edge needed to manage volatility and utilize periodic market imbalances to the portfolio's advantage.

qMML may, from time to time, review and modify the Scheme’s investment strategy if such changes are considered to be in the best interests of the

unitholders and if market conditions warrant it. No assurance can be given that the fund manager will be able to identify or execute such

strategies.

The fund will invest in stocks from a universe of NIFTY 500 TRI selected on the basis of a quantamental models. Quantitative methods will be used

for (i) screening mechanism to choose best picks and make the stock selection universe smaller, (ii) Deciding on the portfolio weightage for better

return as the investment will focus on company’s size and liquidity.

The qualitative model which will be used for stock selection will be based on two broad parameters viz., Stock Price movement & Financial/

valuation aspects. The model will use aspects like:

• Stock Price related parameters – This would include stock specific aspects like relative strength, liquidity and volatility, Historic Performance

(based on quarterly and annual relative and absolute price movement).

• Financial/ Valuation parameters – This would include aspects based on a company’s Balance sheet, cash flow statement & profit & loss

account. The parameters are Sales growth (Historical), Earning before Interest and tax (EBIT) & Free Cash flows. (Historical), Dividend yield,

Price to book ratio (PB), Return ratios, etc. |

The Scheme will invest in a portfolio of Large Cap, Mid Cap and Small Cap companies in line with the investment manager’s views on the

macro economy with a particular focus on the sentiments of the market participants through the interpretation of quant Money Mangers’

predictive analytical tools and macro indicators. The emphasis will be on identifying companies with strong sustainable competitive

advantages in good businesses and having sound managements. The fund managers will follow a dynamic investment strategy taking

defensive/aggressive postures depending on the overall risk-on / risk-off environment. In a risk-off environment, the scheme may invest

substantially in money market instruments to protect the interest of the investors in the scheme.

The portfolio is reviewed consistently on the basis of the macro-economic environment and changes are made based on the data generated

by our analytics and on the discretion of the fund manager. The change in the portfolio involves both sale and purchase, both partial and

complete, of the existing stocks and purchase of new stocks, if any. In lieu of the overarching risk-on / risk-off environment, the scheme

performs a strategic sector rotation in order to generate risk-adjusted returns.

All investment decisions are based on quant money managers’ investment framework – VLRT. In the face of this uncertainty and complexity,

we have found consistent success by studying markets along four dimensions as opposed to limiting ourselves to any one school of thought:

Valuation Analytics, Liquidity Analytics, Risk Appetite Analytics, and Timing. |

The primary investment objective of the Scheme is to seek to generate long-term capital appreciation by creating a portfolio that shall

predominantly invest in equity and equity related instruments falling under the category of large cap companies. Though the benchmark is NIFTY

100 TRI, the investments will not be limited to the companies constituting the benchmark.

The list is only indicative of the universe of stock that the fund may invest into. It is not exhaustive, and the fund may invest in other companies as

well. The fund will combine top down and bottom up approach to construct the portfolio.

QMML may, from time to time, review and modify the Scheme’s investment strategy if such changes are considered to be in the best interests of

the unitholders and if market conditions warrant it. No assurance can be given that the fund manager will be able to identify or execute such

strategies.

The Scheme may also invest a part of its corpus in overseas markets, Global Depository Receipts (GDRs), ADRs, overseas equity, bonds and

mutual funds and such other instruments as may be allowed under the Regulations from time to time.

Portfolio Construction:

The portfolio shall be structured so as to keep risk at acceptable levels based on the risk-on / risk-off environment. This shall be done through

various measures including:

1. Broad diversification of portfolio.

2. Ongoing review of relevant market, industry, sector and economic parameters.

3. Investing in companies which have been based on the VLRT investment framework.

4. Investments in debentures and bonds will usually be in instruments which have been assigned investment grade ratings by any approved rating

agency.

The AMC may, from time to time, review and modify the Scheme’s investment strategy if such changes are considered to be in the best interests

of the unit holders and if market conditions warrant it. Investments in securities and instruments not specifically mentioned earlier may also be

made, provided they are permitted by SEBI/RBI and approved by the Trustee. However, such investments shall be made keeping in view the

Fundamental Attributes of the Scheme.

Subject to the SEBI Regulations, the asset allocation pattern indicated above may change from time to time after receiving an approval from SEBI

and in line with Regulation 18(15A) of SEBI (Mutual Fund) Regulations, 1996, keeping in view market conditions, market opportunities, applicable

regulations and political and economic factors |

The Scheme will dynamically allocate its net assets to equity and equity related securities and debt instruments. The portfolio construct of the

Scheme will be dependent on various factors such as the prevailing market conditions, economic scenarios, global events as deciphered using

our VLRT Investment Framework and Predictive Analytics. The equity exposure is thus dynamically managed and is increased when various

factors are favourable towards equity as an asset class or is brought down when the factors are not favourable.

The scheme’s philosophy is detailed below as per VLRT Investment Framework and Predictive Analytics

The scheme utilizes the VLRT Investment Framework to generate alpha by identifying sectors and securities at their inflection points, enabling

sector rotations, early identification of potential outperformers and constructing a dynamic portfolio between equity and debt. The framework is

composed of four elements: Valuation Analytics, Liquidity Analytics, Risk Appetite Analytics and Timing, with 1/3 weightage given to the first three

components. This approach allows for superior risk management and better timing of investments. Our fund managers specialize in one

component of the framework and investment decisions are made through a focused discussion between managers with diverse capabilities and

experiences. Since September 2019, the fund managers have been using a Dynamic Style of Money Management, adapting the investment

strategy based on the current market environment. They also use market timing indicators as a risk mitigation strategy. This approach to investing

ensures diversification and safeguarding of investor wealth by studying and investing in multiple asset classes, including equity and debt.

Subject to the Regulations, the corpus of the Scheme can be invested in any (but not limited to) of the following securities: Equity and Equity

related instruments, Debt securities (including securitized debt) and money market instruments, Derivatives, foreign securities including

ADR/GDR/Foreign equity and overseas ETFs / mutual fund units, Repo in Corporate Debt, securities lending, Mutual Fund units including ETFs.

Money Market instruments includes (but not limited to) Commercial Paper, Commercial Bills, Certificates of Deposit, Treasury Bills, Bills

Rediscounting, Triparty Repo, Government securities having an unexpired maturity of less than 1 year, alternate to Call or notice money, Usance

Bills and any other such short-term instruments as may be allowed under the Regulations prevailing from time to time.

The portion of the Scheme’s portfolio invested in each type of security may vary in accordance with economic conditions, interest rates, liquidity

and other relevant considerations, including the risks associated with each investment. The Scheme will, in order to reduce the risks associated

with any one security, utilize a variety of investments.

The Scheme may also invest in ADRs / GDRs / Foreign securities/ Foreign Debt/ overseas ETFs Securities / mutual fund units as permitted by

Reserve Bank of India and Securities and Exchange Board of India.

Subject to the Regulations, the securities mentioned in “Where will the Scheme invest” above could be listed, unlisted, privately placed, secured,

unsecured, rated or unrated and of varying maturity. The securities may be acquired through Initial Public Offerings (IPOs), secondary market

operations, private placement, rights offers or negotiated deals.

The Scheme may also enter into repurchase and reverse repurchase obligations in all securities held by it as per the guidelines and regulations

applicable to such transactions. Further the Scheme intends to participate in securities lending as permitted under the Regulations. Investment in

overseas securities shall be made in accordance with the requirements stipulated by SEBI and RBI from time to time. |

The scheme will be a diversified equity fund which will invest predominantly in equity and equity related securities with focus on riding business

cycles through dynamic allocation between various sectors and stocks at different stages of business cycles in the economy.

Business cycles in an economy are typically characterized by the fluctuations in economic activity measured by real GDP growth and other

macroeconomic variables. A business cycle is basically defined in terms of periods of expansion and contraction. During expansion, an economy

experiences an increase in economic activity as evidenced by real GDP growth, industrial production, employment, personal income etc. whereas

during contraction, the pace of economic activity slows down.

The business cycle can be effectively used to position one’s investment portfolio. The business cycle is a critical determinant of equity sector

performance over the intermediate term. The scheme would aim to deploy the business cycle approach in investing by identifying economic

trends and investing in the sectors and stocks that are likely to outperform at any given stage of business cycle.

For example, during period of expansion, the scheme would aim to predominantly invest in stocks of companies in the cyclical sectors as they

tend to outperform the broader market during expansionary phase. Similarly, during period of contraction the scheme would look to invest in

defensive sectors stocks or sectors that are less sensitive to changes in overall economic activity.

Equity Strategy: The scheme would follow the top down approach of portfolio construction to identify the stage of business cycle, through

domestic and global risk appetite and liquidity analytics, to arrive at a risk on/risk off assessment for sectors and stocks. The portfolio will be

constructed on the basis of various broad factors such as prevailing market conditions, domestic and global economic scenarios, business and

consumer sentiment, risk indicators, and a host of proprietary indicators (corporate, geopolitical, socio-cultural, economic, regulatory etc.) forming

part of our Predictive Analytics suite. Coupled with our signature VLRT Framework, as our established risk mitigation tool, the data will be

translated to put forth different scenarios that will highlight relevant sectors and stocks for portfolio construction. The scheme will follow a portfolio

diversification approach across industries/sectors/stocks/market capitalizations at different stages of business cycles in the economy, depending

on prevailing opportunities. The scheme will favour companies that offer the best value relative to their respective long-term growth prospects,

returns on capital, and management quality.

Fixed Income Strategy: The scheme proposes to invest in a diversified portfolio of high quality debt and money market instruments to generate

regular income. The fund manager will allocate the assets of the scheme taking into consideration the prevailing interest rate scenario & the

liquidity of the different instruments.

The portfolio duration and credit exposures will be decided based on a thorough research of the general macroeconomic condition, political and

fiscal environment, systemic liquidity, inflationary expectations, corporate performance and other economic considerations.

The scheme may invest in equity derivatives instruments to the extent permitted under and in accordance with the applicable Regulations,

including for the purposes of hedging, portfolio balancing and optimizing returns. Hedging does not mean maximization of returns but only

attempts to reduce systemic or market risk that may be inherent in the investment.

quant Business Cycle Fund shall aim to provide long term growth by investing at-least 80% of its net assets in equity and equity related

instruments (including equity ETFs) selected on the basis of business cycle. This fund may also invest up to 20% of its net assets into debt &

money market instruments (including debt ETFs), up to 20% into Gold & Silver ETFs or up to 10% in REITs & InVITs. Investments in Foreign

Securities shall not be more than 20%.

Subject to the Regulations, the securities mentioned in “Where will the Scheme invest” above could be listed, unlisted, privately placed, secured,

unsecured, rated or unrated and of varying maturity. The securities may be acquired through Initial Public Offerings (IPOs), secondary market

operations, private placement, rights offers or negotiated deals. |

The primary investment objective of the Scheme is to generate long-term capital appreciation by creating a portfolio that shall

predominantly invest in equity and equity related securities of banking and financial services companies. The fund may invest in

• Banks

• Non-Banking Financial Services Companies

• Housing Finance Companies

• Insurance companies

• Asset Management companies

• Rating agencies

• Microfinance companies

• Broking & securities, insurance & mutual fund platforms

• Asset Reconstruction Companies

• RIAs

• Stock exchanges, depositories and related infrastructure providers

The Fund Manager may, from time to time, review and modify the Scheme’s investment strategy if such changes are considered to be in

the best interests of the unitholders and if market conditions warrant it. No assurance can be given that the fund manager will be able to

identify or execute such strategies.

The Scheme may also invest a part of its corpus in overseas markets in unlisted securities, Global Depository Receipts (GDRs), ADRs,

overseas equity, bonds and mutual funds and such other instruments as may be allowed under the Regulations from time to time.

Portfolio Construction:

The portfolio shall be structured so as to keep risk at acceptable levels based on the risk-on / risk-off environment. This shall be done

through various measures including:

1. Broad diversification of portfolio.

2. Ongoing review of relevant market, industry, sector and economic parameters.

3. Investing in companies which have been based on the VLRT investment framework.